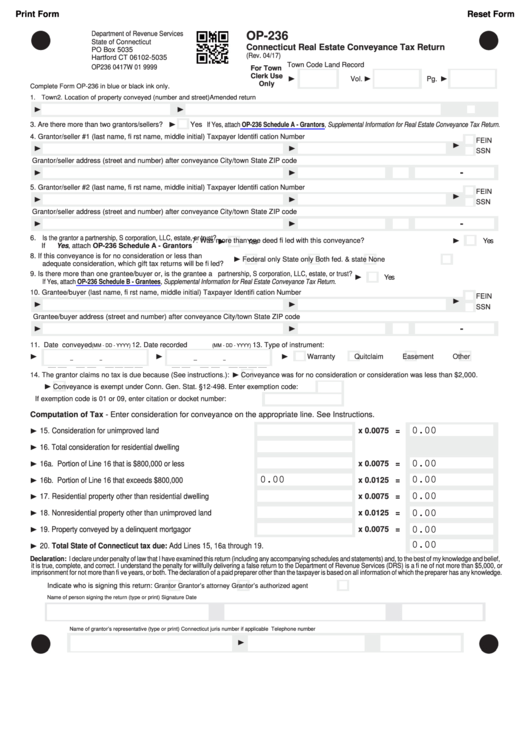

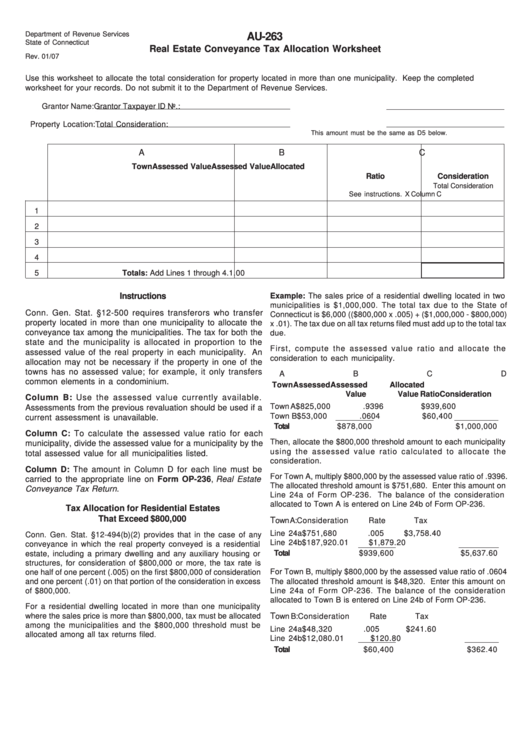

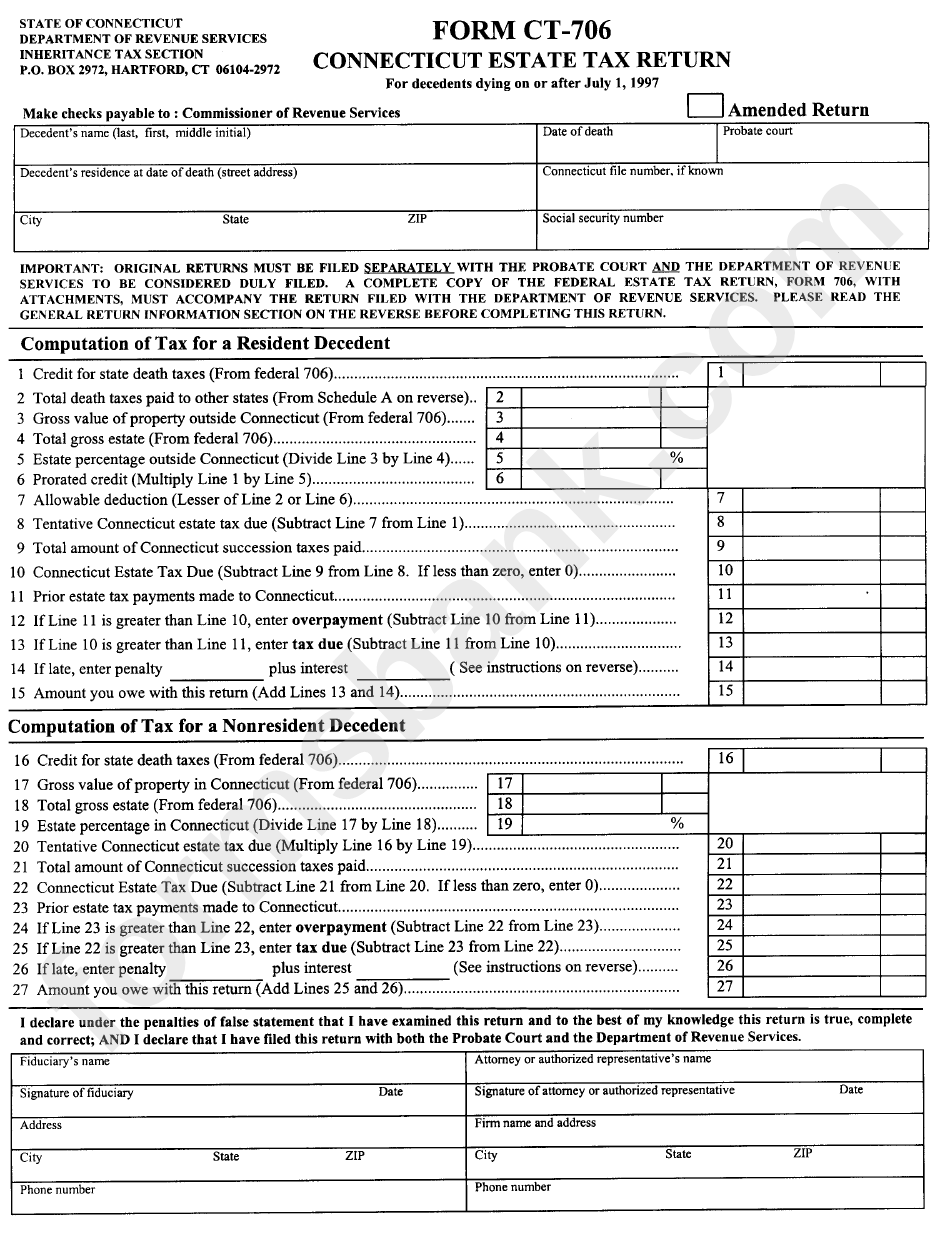

The customer is also able to view the document on the computer screen and to make copies of it also. After scanning, we are able to print the document and put it into a hard-cover book in the vault for immediate use. Accuracy and consistency is of the utmost importance. These are the master indices for all documents recorded in our office. At the end of the month, this index is alphabetized and entered into our Grantor/Grantee Indices. It is edited and corrected, then run off and put into a daybook, which is a chronological index of documents. The document is then indexed into our computer system and a list is run off. We darken all seals so they will show up in microfilming. Next, we assign a volume and page to the document, stamp it with the conveyance tax collected and with a "received for record stamp" showing date and time of receipt. If there is no price stated in the deed, a Town Conveyance Tax form must accompany the deed, stating the price paid. This must be forwarded to the Department of Revenue Services in a timely manner. We assess the charge for the tax and attach the check which is made out to Commissioner of Revenue Services to the form. The return must be complete and accurate. For this we receive no compensation.Ī Connecticut Real Estate Conveyance Tax Return must accompany the deed when it is recorded.

In this regard, one of our functions is acting as the Tax Collector for the Connecticut Department of Revenue Services.

We accept the document for recording, stamp it with the date and time, calculate the recording fees and collect a State conveyance tax and a Town conveyance tax according to the sales price. One of our primary functions is the recording and processing of land records.

0 kommentar(er)

0 kommentar(er)